Oikeushenkilötunnus: 743700NUZHA6YMHS8Y78

green bondien osuus rahastosta

rahaston velkakirjasijoitusten rahoittamien hankkeiden avulla vältettyjen päästöjen määrä

rahaston kestävien sijoitusten osuus

rahaston EU-taksonomian mukaisen sijoitusten osuus

kansainvälisten normien rikkojien osuus rahastosta.

Seuraavista PAI-indikaattoreista huomioidaan ne, jotka on tunnistettu oleellisiksi kyseiselle sijoituskohteelle: kasvihuonekaasupäästöt, hiilijalanjälki, sijoituskohteina olevien yritysten kasvihuonekaasuintensiteetti, fossiilisten polttoaineiden alalla toimiviin yrityksiin liittyvä vastuu, uusiutumattoman energian kulutuksen ja tuotannon osuus, energiankulutuksen intensiteetti ilmastovaikutukseltaan merkittävää alaa kohden, toiminnat jotka vaikuttavat kielteisesti biologisen monimuotoisuuden kannalta herkkiin alueisiin, päästöt veteen, vaarallisen jätteen ja radioaktiivisen jätteen määrä, YK:n Global Compact periaatteiden ja monikansallisille yrityksille annettujen Taloudellisen yhteistyön ja kehityksen järjestön (OECD) toimintaohjeiden rikkomiset, YK:n Global Compact periaatteiden tai monikansallisille yrityksille annettujen OECD:n toimintaohjeiden noudattamisen seuraamista koskevien prosessien ja mekanismien puute, sukupuolten välinen tasoittamaton palkkaero, sukupuolten moninaisuus hallituksessa, altistuminen kiistanalaisiin aseisiin (jalkaväkimiinat, tytärammukset, kemialliset aseet ja biologiset aseet) liittyvälle riskille, veden kulutus ja kierrätys, ihmisoikeuksiin liittyvien toimintaperiaatteiden puute sekä korruption ja lahjonnan torjuntaa koskevien toimintaperiaatteiden puute.

Sijoituskohteiden edellytetään noudattavan kansainvälisesti tunnistettuja hyvän hallintotavan käytäntöjä, joita määritellään muun muassa yritystoimintaa ja yhteiskuntaa ohjaavilla kansainvälisillä konventioilla kuten YK:n Global Compact sekä paikallisilla hallintokoodeilla. Hyvän hallintotavan riittävä toteutuminen arvioidaan sijoituskohteen kestävyysanalyysin yhteydessä sekä seuraamalla kansainvälisten konventioiden määrittämien normien toteutumista tai niiden rikkomista sijoituskohteiden toiminnassa.

Edellä mainituilla rajauksilla sekä yrityskohtaisella hyvän hallintotavan toteutumisen analyysillä pyritään varmistamaan, että sijoituskohteena olevat yritykset noudattavat hyviä hallintotapoja. Sijoituskohteiden edellytetään noudattavan kansainvälisesti tunnistettuja hyvän hallintotavan käytäntöjä, joita määritellään muun muassa yritystoimintaa ja yhteiskuntaa ohjaavilla kansainvälisillä konventioilla kuten YK:n Global Compact sekä paikallisilla hallintokoodeilla. Hyvän hallintotavan riittävä toteutuminen arvioidaan sijoituskohteen kestävyysanalyysin yhteydessä sekä seuraamalla kansainvälisten konventioiden määrittämien normien toteutumista tai niiden rikkomista sijoituskohteiden toiminnassa. Hyvää hallintotapaa noudattavien sijoituskohteiden tunnistamisessa hyödynnetään palveluntarjoajien Governance-analyysejä ja -mittareita osana omaa kestävyysanalyysiä. Sijoitusuniversumista suljetaan pois yhtiöt, jotka ovat rikkoneet kansainvälisiä ihmisoikeuksia, työvoimaa, ympäristöä tai korruptiota koskevia normeja.

green bondien osuus rahastosta

rahaston velkakirjasijoitusten rahoittamien hankkeiden avulla vältettyjen päästöjen määrä

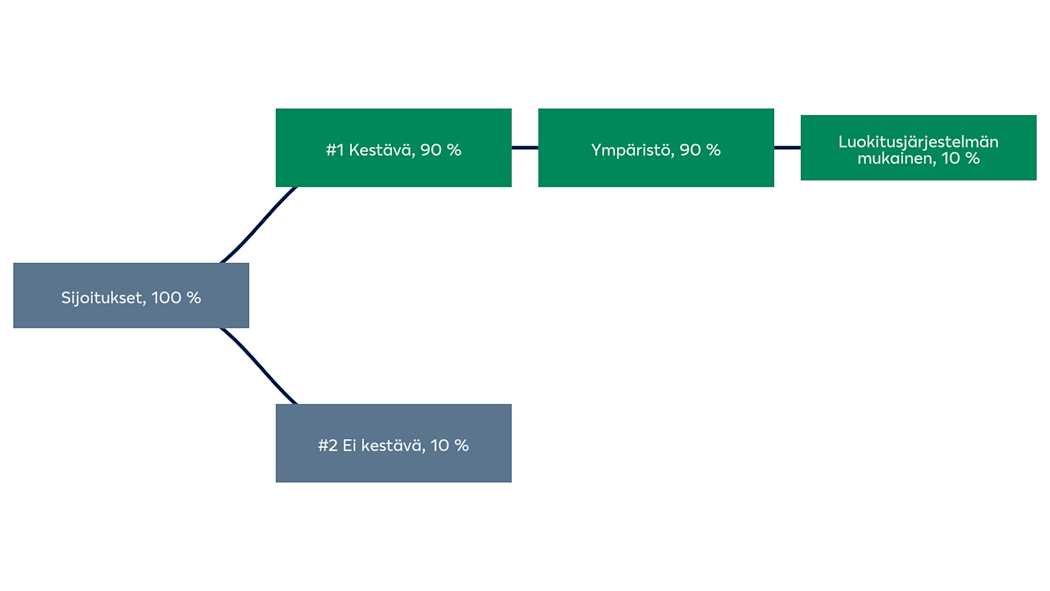

rahaston kestävien sijoitusten osuus

rahaston EU-taksonomian mukaisen sijoitusten osuus

kansainvälisten normien rikkojien osuus rahastosta.