Oikeushenkilötunnus: 743700KTZ40LUSMWN477

rahaston hiili-intensiteetti (WACI), scope 1+2

rahaston hiili-intensiteetti (WACI), scope 1+2+3

green bondien osuus rahastosta

kansainvälisten normien rikkojien osuus rahastosta.

Siltä osin kuin rahastossa aiotaan tehdä kestäviä sijoituksia, haitallisia vaikutuksia koskevat indikaattorit otetaan huomioon sijoituskohteen kestävyysanalyysissä, jossa tunnistetaan ja huomioidaan kullekin sijoituskohteelle oleelliset haittavaikutukset, ottaen huomioon yleiset haittavaikutukset sekä toimiala- ja yrityskohtaiset erityispiirteet. Kestävyysanalyysin yhteydessä arvioidaan, ettei sijoitus aiheuta merkittävää haittaa kestävien sijoitusten tavoitteelle. Sijoitusuniversumista suljetaan pois yhtiöt, jotka ovat rikkoneet kansainvälisiä ihmisoikeuksia, työvoimaa, ympäristöä tai korruptiota koskevia normeja. Rahaston sijoituspäätöksissä huomioidaan ympäristöön, sosiaaliseen vastuuseen ja hyvään hallintotapaan liittyvät tekijät (ESG) LähiTapiola Varainhoitokonsernin kestävän sijoitustoiminnan periaatteiden mukaisesti.

Rahasto ei sijoita yhtiöihin, jotka ovat rikkoneet kansainvälisiä ihmisoikeuksia, työvoimaa, ympäristöä tai korruptiota koskevia normeja.

Rahasto ei sijoita yhtiöihin, jotka valmistavat kiistanalaisia aseita tai niiden valmistamiseen käytettäviä komponentteja.

Rahasto ei sijoita yhtiöihin, joiden liikevaihdosta yli 5 prosenttia tulee aikuisviihdetuotteista ja -palveluista, perinteisten aseiden valmistuksesta, tupakkatuotteiden valmistuksesta, uhkapeleistä tai kuluttajille suunnatuista pikaluotoista.

Rahasto ei sijoita ESG-profiililtaan heikoimmiksi arvioituihin sijoituskohteisiin.

Rahaston hiiliriskiä rajataan erilaisin toimin, joista kerrotaa tarkemmin Varainhoitokonsernin kestävän sijoitustoiminnan periaatteissa.

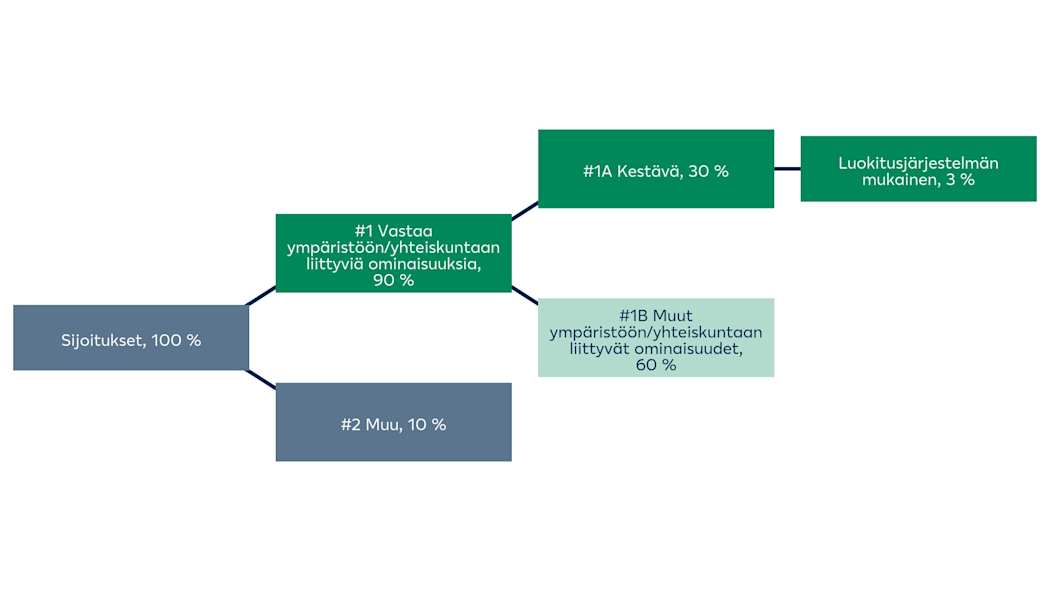

alaluokka #1A Kestävä kattaa kestävät sijoitukset, joilla on ympäristöön tai yhteiskuntaan liittyviä tavoitteita.

alaluokka #1B Muut ympäristöön/yhteiskuntaan liittyvät ominaisuudet kattaa sijoitukset, jotka vastaavat ympäristöön tai yhteiskuntaan liittyviä ominaisuuksia ja joita ei pidetä kestävinä sijoituksina.

rahaston hiili-intensiteetti (WACI), scope 1+2

rahaston hiili-intensiteetti (WACI), scope 1+2+3

green bondien osuus rahastosta

kansainvälisten normien rikkojien osuus rahastosta.